Best Performing Superannuation funds in Australia

These kinds of deductions can really chip away at your retirement savings. It's also important to know whether you're in a retail or industry super fund – fees for retail funds are usually higher.

Superannuation fees are often hard to detect, and the financial services industry is fighting hard to keep it that way - in part by getting rid of the "opt in" clause in the

(FoFA) reforms, which demand better fee disclosure.

In this article, we show you how to find the best-performing super fund and outline which funds charge the lowest fees.

Can you do better?

Superannuation account returns have been on the rise after taking a beating at the hands of the global financial crisis. Median balanced funds (in most cases the default option) posted a healthy 16%+ return for 2013 – a big improvement on the previous three years, when most accounts earned about 8.6% a year.

But that doesn't mean your fund is in the winner's column, especially if the fund manager has a conflict of interest problem – and there's plenty of that going around. Recent revelations about super funds investing in the banks that own them instead of shopping around for the best return should serve as a cautionary message for people just starting to build their nest eggs. The mismanagement has reportedly meant returns as low as 1.38%, well below the inflation rate. Add in high fees and your super account could really lose value over the long run.

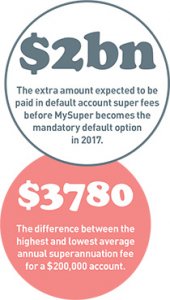

MySuper savings

It's not surprising that most people don't know much about where their superannuation money is going. About 70% of Australian employees leave it up to their employer to choose their super account.

The launch of the government's MySuper scheme means employers now have to make sure default superannuation accounts (where your money ends up if you don't make a choice) are in a fund that offers a MySuper option. As of February 2014, the introduction of the scheme had caused fees to drop by 26% across the industry.